OUR ROADMAP ROADMAP

October 2021

Research and Development.

December 2021

Main Tasks Completed (i.e. Whitepaper, Tokenomics, Roadmap, etc.)

February 2022

TREP incorporation in Wyoming, USA

March 2022

Pre-launch – Tokens available for purchase @ Price of $0.75 / Token

April 2022

Formal Launch – Tokens available for sale @ Launch price of $1.00 / Token (Reg D 506(c) Offering)

May 2022

First Syndication Under Contract

July 2022

Second Syndication Under Contract

August 2022

Third Syndication Under Contract

September 2022

Aim to receive full approval for SEC Reg A+ Filing

October 2022

Listing on multiple exchanges to support a more liquid market for TREP Tokens

OUR ROADMAP ROADMAP

October 2021

Research and Development.

December 2021

Main Tasks Completed (i.e. Whitepaper, Tokenomics, Roadmap, etc.)

February 2022

TREP incorporation in Wyoming, USA

March 2022

Pre-launch – Tokens available for purchase @ Price of $0.75 / Token

April 2022

Formal Launch – Tokens available for sale @ Launch price of $1.00 / Token (Reg D 506(c) Offering

May 2022

First Syndication Under Contract

July 2022

Second Syndication Under Contract

August 2022

Third Syndication Under Contract

September 2022

Aim to receive full approval for SEC Reg A+ Filing

October 2022

Listing on multiple exchanges to create liquid market for TREP Tokens

Frequently asked questions FAQS

Tokenized Real Estate Properties

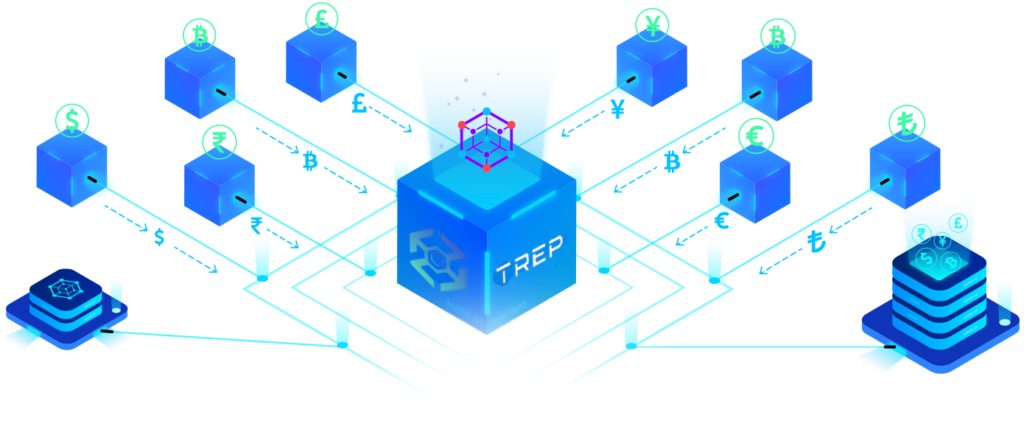

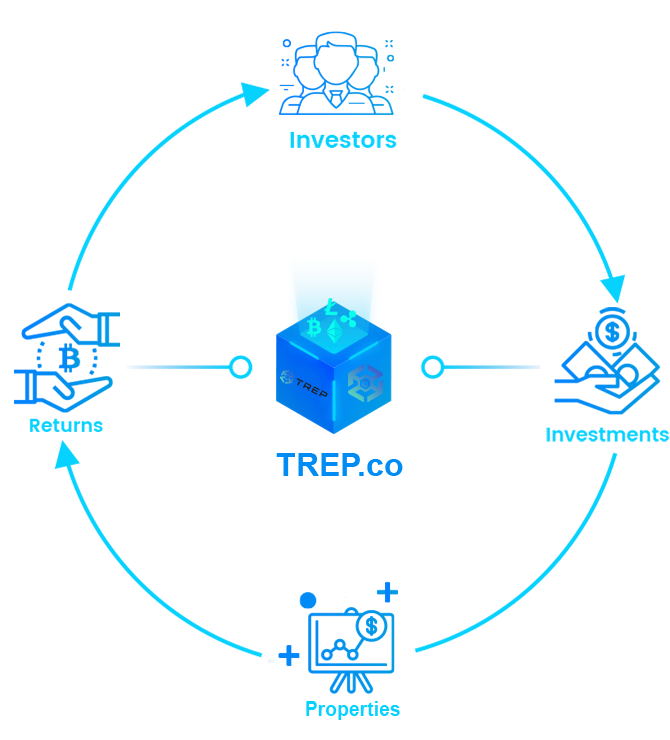

TREP’s primary objective as a company is to make real estate much more accessible and affordable for people all over the world through tokenization.

TREP makes money in multiple ways including (1) investing directly in real estate; (2) investing in Tax Liens and Tax Deeds; (3) tokenizing real estate; and (4) structuring syndications.

Upon a successful filing with the SEC, TREP’s Security Token Offering (STO) would have zero minimum investment requirements. However, if an investor wishes to participate during the Pre-Launch phase, the minimum investment is $50,000 (US) and accredited investor status.

Depends on where one is located. For international investors, there is no minimum investment. For US investors, the minimum investment is $50,000, and they must be accredited per SEC requirements.

Syndications are essentially properties which are fractionalized so investors can participate by making any size investment they wish. The syndication is structured and managed by a Sponsor.

No, investors will own a share of the property with other investors, similar to owning a share of a publicly traded company.

Mostly commercial properties which possess strong rental income. This can also include large residential communities, warehouses, hotels, etc.

No. TREP manages the property portfolio, however a local property management company is hired to oversee the day-to-day operation of each property and held accountable for maintaining occupancy, property upkeep, and rent collection.

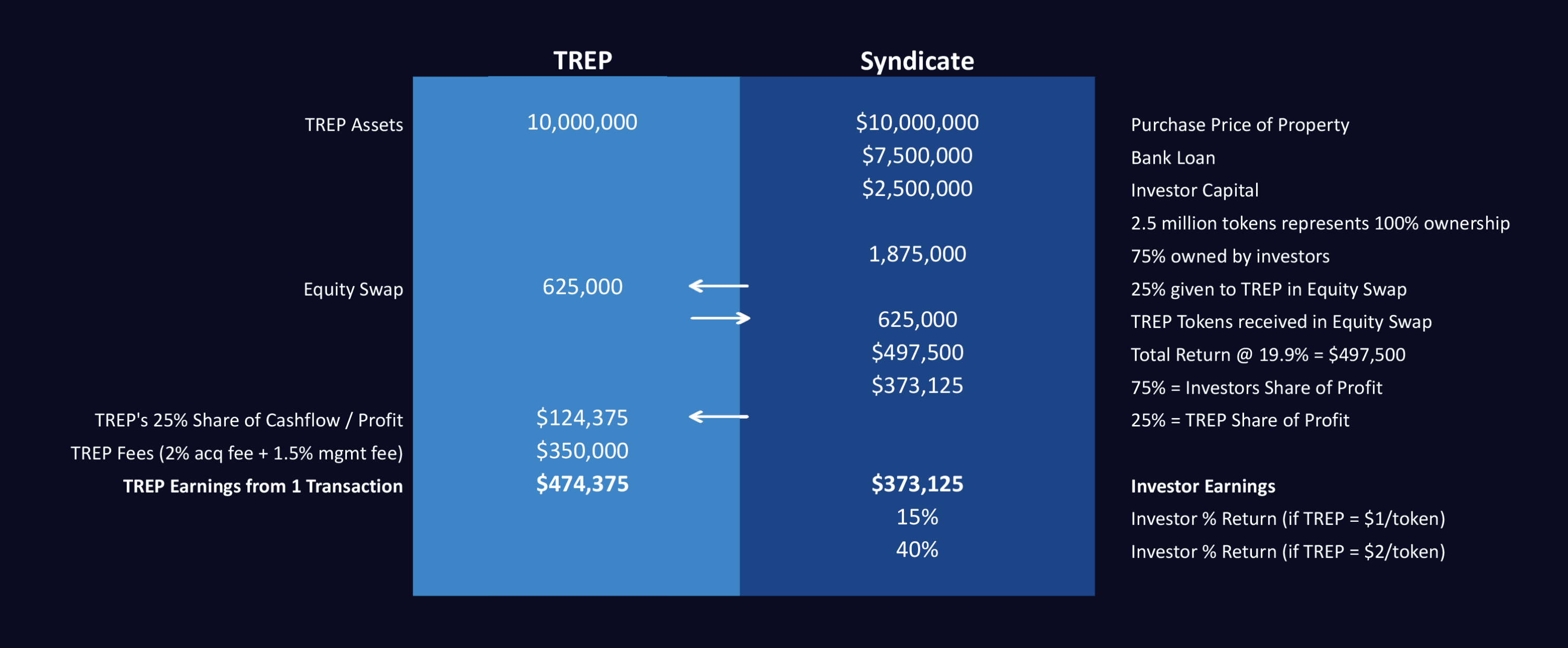

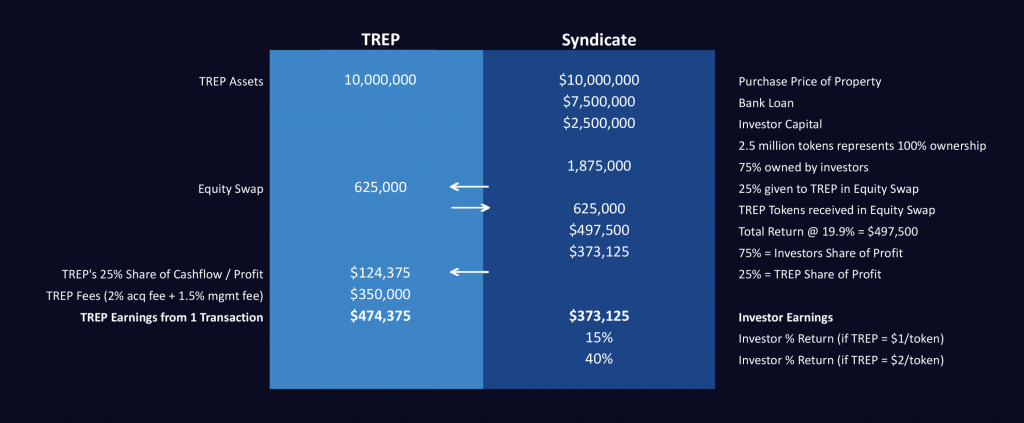

TREP earns a one-time Acquisition Fee of 2%, an annual Property Management Fee of 1.5%, and a Capital Event Fee of 1%. Plus, TREP receives a 25% equity interest in each syndication through an Equity Swap, thus TREP also earns 25% of the net cashflow from each property.

Yes, a portion of the rental income is distributed each month to syndicate investors in proportion to their ownership of the property.

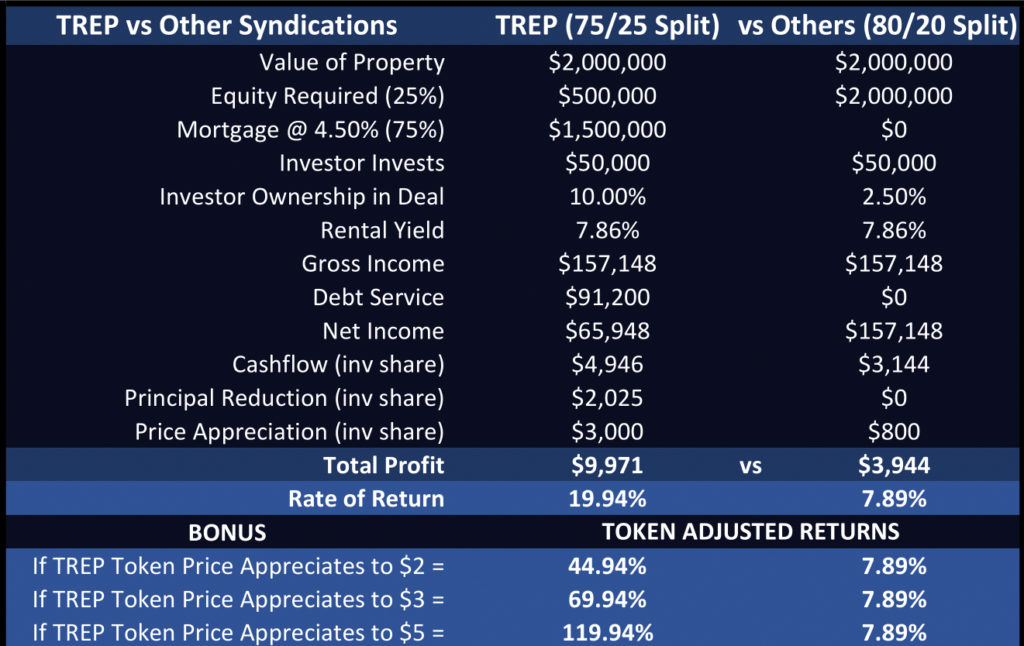

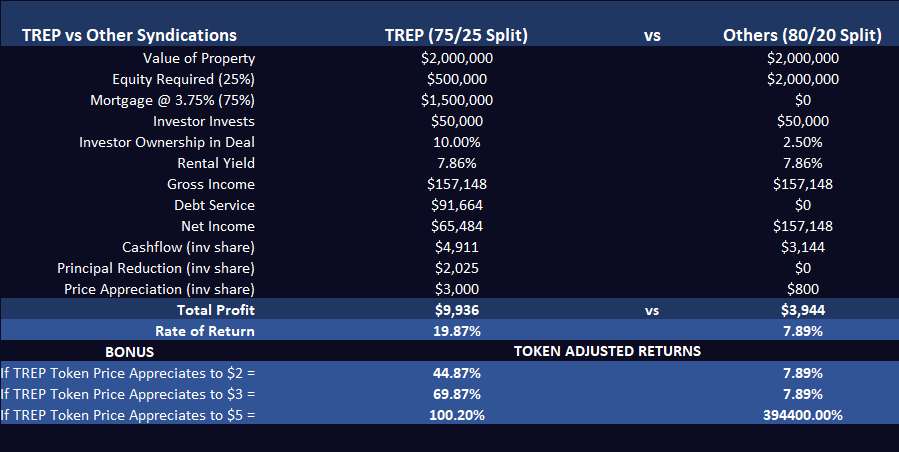

In a TREP syndication, the investment is fully collateralized by the property, but the investor enters into an equity swap of 25% of his equity in the property in exchange for an equal value of equity in TREP Tokens.

The equity swap allows a syndicate investor to diversify their investment while having the potential to earn a much greater return. For example, if the TREP Tokens received in the swap increase in price from $1 to $2, a syndicate investor can experience significantly higher returns compared to regular syndications.

TREP is required to deliver the difference up to the value of the property it received, thus protecting the investor’s downside. The property always acts as the ultimate collateral for the investment. The only way a loss can take place in this structure is if the property itself declines in value. (See Risk Factors in PPM)

The maximum liability for syndication investors is limited to the size of their investment, thus if a property requires additional capital due to deferred maintenance or a drop in occupancy, investors are not bothered. TREP covers the liability and will be reimbursed from future cashflow or upon the sale of the property, providing peace of mind for investors.

Yes, TREP Tokens may be sold any time following the minimum one-year hold after issuance.

Yes, TREP is designed to distribute 100% of its net profits to its token holders each year. Following Year 1, dividends are planned to be paid quarterly.

No. Both investments are real estate based, but investors in a REIT earn from the cashflow and price appreciation of the REIT’s portfolio, whereas TREP investors earn from the cashflow and appreciation of the TREP portfolio, plus from fees earned by providing tokenization as a service each year. Upside is greater in TREP compared to a REIT. For more clarity, see TREP Whitepaper.

Yes. TREP takes advantage of competitively low interest rates in the US to finance as much as 80% of the purchase price of its property acquisitions. This aids TREP in providing higher returns compared to traditional syndications that do not utilize financing.

Investing in TREP means an ownership interest in the syndicator, thus a share of the fees earned for creating / managing syndications, and the 25% equity received from each property syndicated. An investment in a TREP Syndication means an investment in and collateralized by a specific property and any related cashflow or price appreciation from that single property.

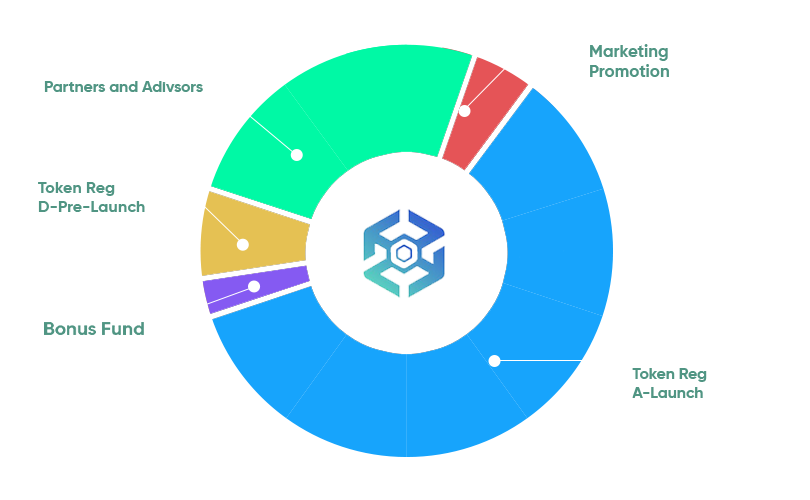

TREP Tokens are considered Security Tokens, because they represent an actual ownership interest in TREP and a share of the Company’s cashflow, unlike utility tokens which provide zero ownership and only a utility benefit for owning those tokens.

This depends on the timing of the investment. For example, any international investor may purchase TREP Tokens during the Pre-Launch phase through the Company’s Reg S offering, however in the US, only “accredited investors” may acquire TREP Tokens utilizing the Reg D 506(c) exemption provided by the SEC. During the formal launch of the STO, any US or international investor may acquire TREP Tokens.

Yes, the restriction period is 12 months. During this period, investors cannot sell or transfer their Tokens.

No. The STO tokens would be offered through a Reg A+ offering which requires an SEC registration. The Reg A would allow the Company to raise up to $75 million from investors against free-trading shares / tokens upon qualification of the Offering by the SEC.

TREP Tokens will first be traded on TREP’s platform where individuals can place their bid and ask offers. TREP also intends to register with crypto exchanges and ATS’ (Alternative Trading Systems) to provide added liquidity for its Tokens, so investors can have multiple options to trade TREP tokens.

Frequently asked questions FAQS

Tokenized Real Estate Properties

TREP’s primary objective as a company is to make real estate much more accessible and affordable for people all over the world through tokenization.

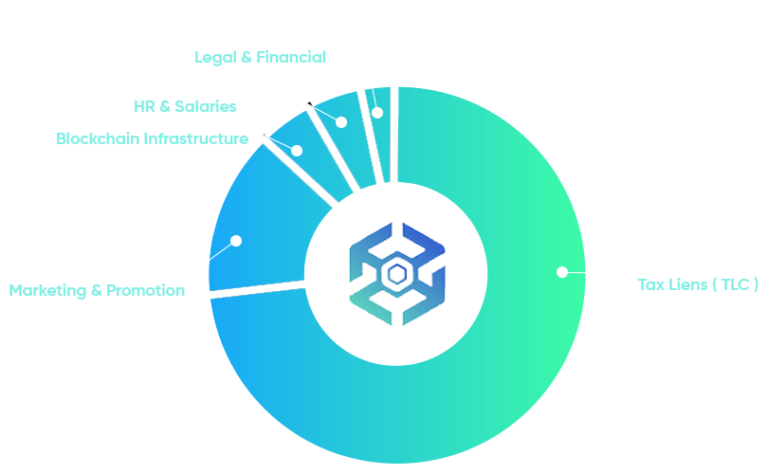

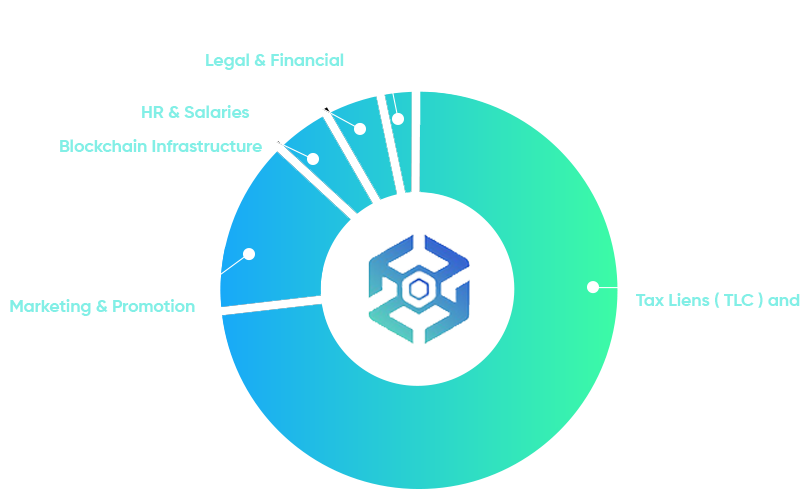

TREP makes money in multiple ways including (1) investing directly in real estate; (2) investing in Tax Liens and Tax Deeds; (3) tokenizing real estate; and (4) structuring syndications.

Upon a successful filing with the SEC, TREP’s Security Token Offering (STO) would have zero minimum investment requirements. However, if an investor wishes to participate during the Pre-Launch phase, the minimum investment is $50,000 (US) and accredited investor status.

Depends on where one is located. For international investors, there is no minimum investment. For US investors, the minimum investment is $50,000, and they must be accredited per SEC requirements.

Syndications are essentially properties which are fractionalized so investors can participate by making any size investment they wish. The syndication is structured and managed by a Sponsor.

No, investors will own a share of the property with other investors, similar to owning a share of a publicly traded company.

Mostly commercial properties which possess strong rental income. This can also include large residential communities, warehouses, hotels, etc.

No. TREP manages the property portfolio, however a local property management company is hired to oversee the day-to-day operation of each property and held accountable for maintaining occupancy, property upkeep, and rent collection.

TREP earns a one-time Acquisition Fee of 2%, an annual Property Management Fee of 1.5%, and a Capital Event Fee of 1%. Plus, TREP receives a 25% equity interest in each syndication through an Equity Swap, thus TREP also earns 25% of the net cashflow from each property.

Yes, a portion of the rental income is distributed each month to syndicate investors in proportion to their ownership of the property.

In a TREP syndication, the investment is fully collateralized by the property, but the investor enters into an equity swap of 25% of his equity in the property in exchange for an equal value of equity in TREP Tokens.

The equity swap allows a syndicate investor to diversify their investment while having the potential to earn a much greater return. For example, if the TREP Tokens received in the swap increase in price from $1 to $2, a syndicate investor can experience significantly higher returns compared to regular syndications.

TREP is required to deliver the difference up to the value of the property it received, thus protecting the investor’s downside. The property always acts as the ultimate collateral for the investment. The only way a loss can take place in this structure is if the property itself declines in value. (See Risk Factors in PPM)

The maximum liability for syndication investors is limited to the size of their investment, thus if a property requires additional capital due to deferred maintenance or a drop in occupancy, investors are not bothered. TREP covers the liability and will be reimbursed from future cashflow or upon the sale of the property, providing peace of mind for investors.

Yes, TREP Tokens may be sold any time following the minimum one-year hold after issuance.

Yes, TREP is designed to distribute 100% of its net profits to its token holders each year. Following Year 1, dividends are planned to be paid quarterly.

No. Both investments are real estate based, but investors in a REIT earn from the cashflow and price appreciation of the REIT’s portfolio, whereas TREP investors earn from the cashflow and appreciation of the TREP portfolio, plus from fees earned by providing tokenization as a service each year. Upside is greater in TREP compared to a REIT. For more clarity, see TREP Whitepaper.

Yes. TREP takes advantage of competitively low interest rates in the US to finance as much as 80% of the purchase price of its property acquisitions. This aids TREP in providing higher returns compared to traditional syndications that do not utilize financing.

Investing in TREP means an ownership interest in the syndicator, thus a share of the fees earned for creating / managing syndications, and the 25% equity received from each property syndicated. An investment in a TREP Syndication means an investment in and collateralized by a specific property and any related cashflow or price appreciation from that single property.

TREP Tokens are considered Security Tokens, because they represent an actual ownership interest in TREP and a share of the Company’s cashflow, unlike utility tokens which provide zero ownership and only a utility benefit for owning those tokens.

This depends on the timing of the investment. For example, any international investor may purchase TREP Tokens during the Pre-Launch phase through the Company’s Reg S offering, however in the US, only “accredited investors” may acquire TREP Tokens utilizing the Reg D 506(c) exemption provided by the SEC. During the formal launch of the STO, any US or international investor may acquire TREP Tokens.

Yes, the restriction period is 12 months. During this period, investors cannot sell or transfer their Tokens.

No. The STO tokens would be offered through a Reg A+ offering which requires an SEC registration. The Reg A would allow the Company to raise up to $75 million from investors against free-trading shares / tokens upon qualification of the Offering by the SEC.

TREP Tokens will first be traded on TREP’s platform where individuals can place their bid and ask offers. TREP also intends to register with crypto exchanges and ATS’ (Alternative Trading Systems) to provide added liquidity for its Tokens, so investors can have multiple options to trade TREP tokens.