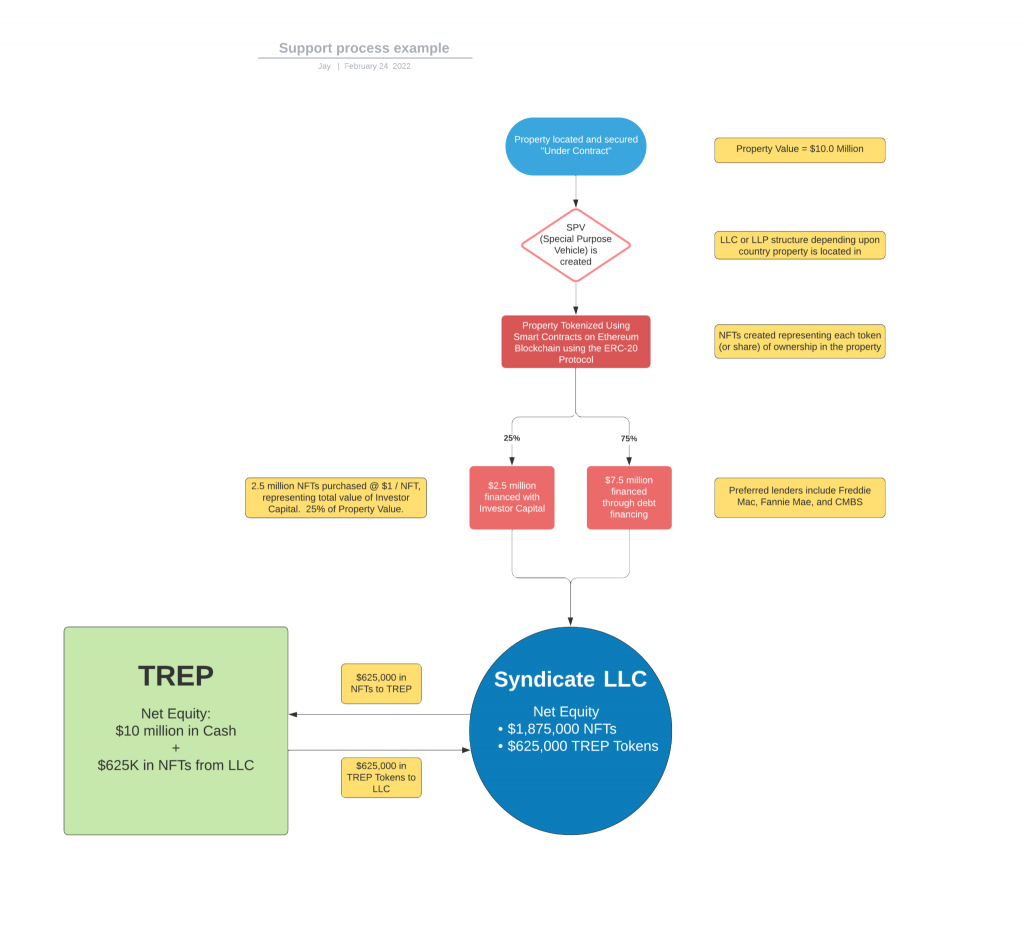

Each property offered through TREP is tokenized by first acquiring it through a Special Purpose Vehicle (SPV) such as a Limited Liability Company (LLC). The membership interests of the LLC representing 100% of the equity in the property will be divided into $1 units and entered into blockchain using smart contracts on the Ethereum (ERC-3643) platform. These units are also called “Tokens” and ownership of a specific number of tokens provides individuals their corresponding prorated ownership interest in the property. In short, 100% of the tokens represent 100% equity ownership of the property held by the LLC.

Powering Real Estate For

The New Equity Blockchain

Making Real Estate Accessible for All Throughout the World.

Powering Data for the new equity blockchain

Global decentralize network to buy & sell shares

Invest in TREP:

With its unique structure, TREP is the first asset-backed token in the real estate space that is capable of delivering returns higher than REITs or any individually owned property. Imagine a collateralized investment with the upside of a high-growth tech stock. This is the future of real estate investing!

Is that even possible? Yes, welcome to TREP!

Reasons to Invest

Top Asset Class

Real estate is one of the top performing asset classes in the world and provides an excellent combination of return and security.

No Minimums

TREP makes real estate investing accessible for all investors, large or small with no minimum investment.

Income Generation

TREP pays annual dividends from total cashflow!

Compounded Growth

Dividends are designed to grow each year the investment is held, providing excellent income for investors.

Asset-Backed

TREP is backed by physical properties, not simply technology which can become obsolete tomorrow.

Liquidity

Real estate is typically considered a long-term investment, but with TREP, investors can buy or sell at any time.

Security Token

TREP is a security token, which means investors will have an actual ownership interest in the company unlike 90% of the cryptos in the world.

Liquidity

Real estate is typically considered a long-term investment, but with TREP, investors can buy or sell at any time.

How is a Property Tokenized?

When a property is legally represented by tokens on the Ethereum platform, the property is then able to gain all the qualities of a cryptographic token, while retaining the original value of the underlying asset.

Tokenization enables the transparent ownership and efficient exchange of a physical asset possible. This important step now turns real estate into a liquid asset, and one which does not require a large investment, lengthy hold periods, or expensive transaction costs. It also allows large top-performing commercial properties to become available to the common man, making all types of real estate truly accessible.

How does TREP make money?

2% Acquisition Fee for sourcing, negotiating, and structuring the transaction, arranging financing, and other contributions towards the overall success of the purchase.

1.5% Asset Management Fee for managing all business affairs related to the property.

1.0% Capital Event Fee – one-time fee paid to TREP for working with a lender to structure a refinance of the property or working with brokers to successfully complete a sale of the asset.

25% Equity Interest in the property through an Equity Swap with the owners of the property.

How does TREP make money?

2% Acquisition Fee for sourcing, negotiating, and structuring the transaction, arranging financing, and other contributions towards the overall success of the purchase.

1.5% Asset Management Fee for managing all business affairs related to the property.

1.0% Capital Event Fee – one-time fee paid to TREP for working with a lender to structure a refinance of the property or working with brokers to successfully complete a sale of the asset.

25% Equity Interest in the property through an Equity Swap with the owners of the property.

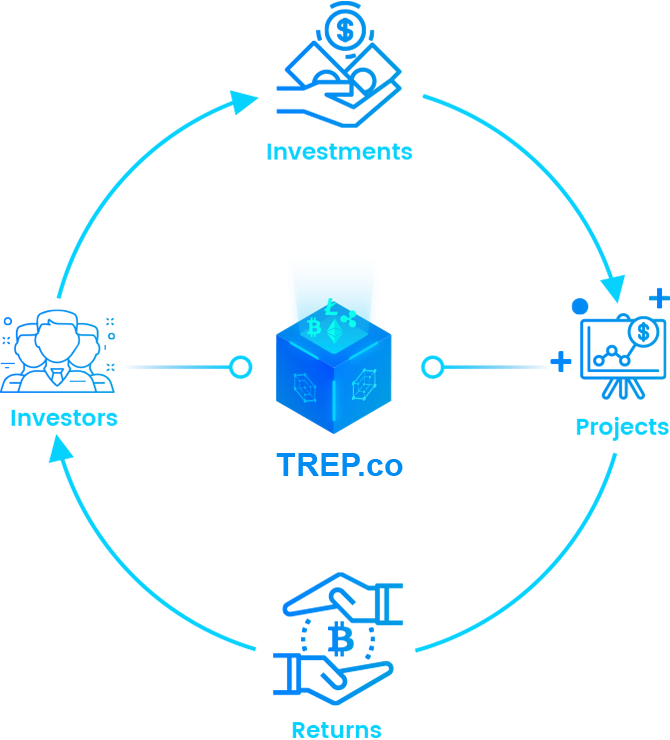

What is ICO Crypto?

ICO Crypto is a platform for the future of funding that powering dat for the new equity blockchain.

While existing solutions offer to solve just one problem at a time, our team is up to build a secure, useful, & easy-to-use product based on private blockchain. It will include easy cryptocurrency payments integration, and even a digital arbitration system.

At the end, Our aims to integrate all companies, employees, and business assets into a unified blockchain ecosystem, which will make business truly efficient, transparent, and reliable.

We’ve Built A Platform To Help You Buy And Sell Real Estate Within Seconds And Without Any Hassles!